IATA reveals passenger and air cargo demand up over 8% in November

Image courtesy IATA

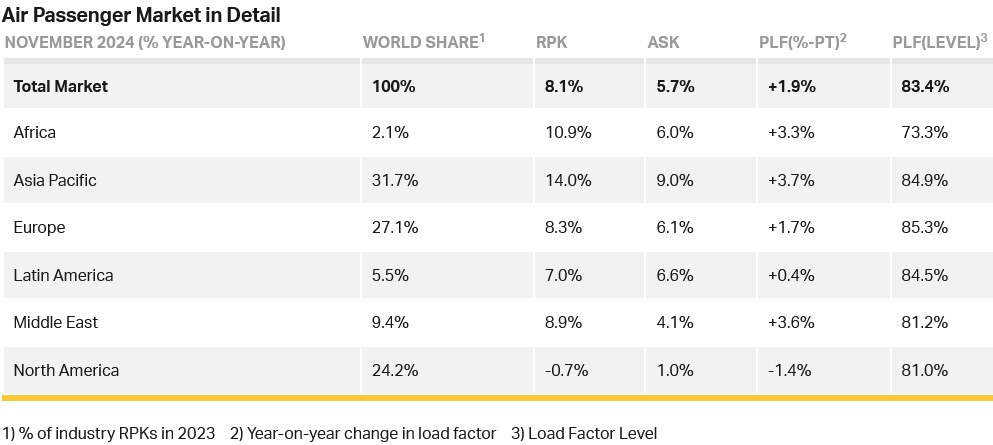

Total passenger demand, measured in revenue passenger kilometres (RPK), was up 8.1% compared to November 2023. Total capacity, measured in available seat kilometres (ASK), was up 5.7% year-on-year. The November load factor was 83.4% (+1.9 ppt compared to November 2023), an all-time high for November.

International demand rose 11.6% compared to November 2023. Capacity was up 8.6% year-on-year, and the load factor was 83.4% (+2.3 ppt compared to November 2023). Strong performance by carriers in Europe and Asia-Pacific drove this double-digit expansion in demand.

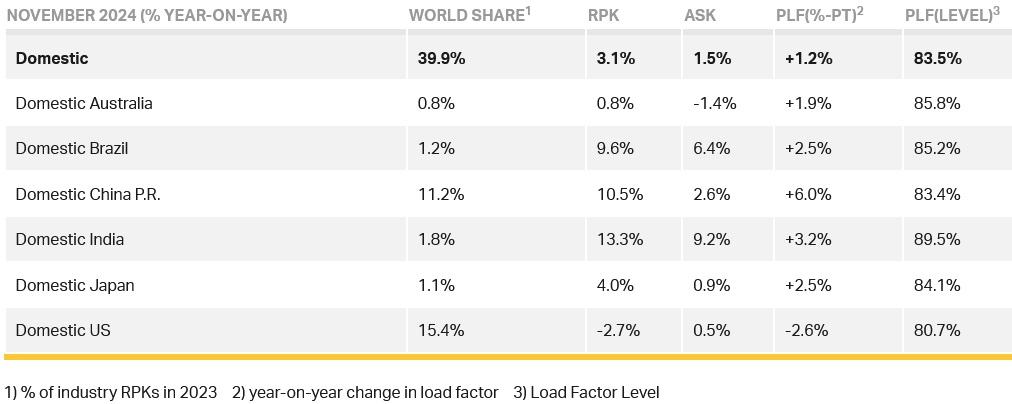

Domestic demand rose 3.1% compared to November 2023. Capacity was up 1.5% year-on-year and the load factor was 83.5% (+1.2 ppt compared to November 2023).

Willie Walsh (above), IATA’s Director General, said: “November was another month of strong growth in the demand for air travel with an overall expansion of 8.1%. The month was also another reminder of the supply chain issues that are preventing airlines from getting the aircraft they need to meet growing demand. Capacity growth is lagging demand by 2.4 ppts and load factors are at record levels.

"Airlines are missing out on opportunities to better serve customers, modernise their products and improve their environmental performance because aircraft are not being delivered on time. The 2025 New Year’s resolution for the aerospace manufacturing sector must be finding a fast and durable solution for their supply chain issues.”

Regional Breakdown - International Passenger Markets

All regions showed growth for international passenger markets in November 2024 compared to November 2023. Europe had the highest load factors (85.0%) while Asia-Pacific led on growth with a 19.9% year-on-year expansion in demand.

Asia-Pacific airlines achieved a 19.9% year-on-year increase in demand. Capacity increased 16.2% year-on-year and the load factor was 84.9% (+2.6 ppt compared to November 2023).

European carriers had a 9.4% year-on-year increase in demand. Capacity increased 7.1% year-on-year, and the load factor was 85.0 % (+1.8 ppt compared to November 2023).

Middle Eastern carriers saw an 8.7% year-on-year increase in demand. Capacity increased 3.9% year-on-year and the load factor was 81.0% (+3.6 ppt compared to November 2023).

North American carriers saw a 3.1% year-on-year increase in demand. Capacity increased 1.6% year-on-year, and the load factor was 81.0% (+1.1 ppt compared to November 2023).

Latin American airlines saw an 11.4% year-on-year increase in demand. Capacity climbed 11.9% year-on-year. The load factor was 84.4% (-0.4 ppt compared to November 2023).

African airlines saw a 12.4% year-on-year increase in demand. Capacity was up 6.0% year-on-year. The load factor rose to 72.9% (+4.1 ppt compared to November 2023).

Domestic Passenger Markets

Domestic RPK increased 3.1% over the previous year, decelerating slightly from the 3.5% growth posted in October. Signs of stable growth were shown in all markets except in the US which saw a 2.7% contraction, deeper than the 1.2% year-on-year dip recorded in October. This is part of a slowing trend in the US domestic market since June 2024 and mainly reflects lower low-cost carrier activity. US mainline carriers have continued to see growth over the same period.

Air Cargo

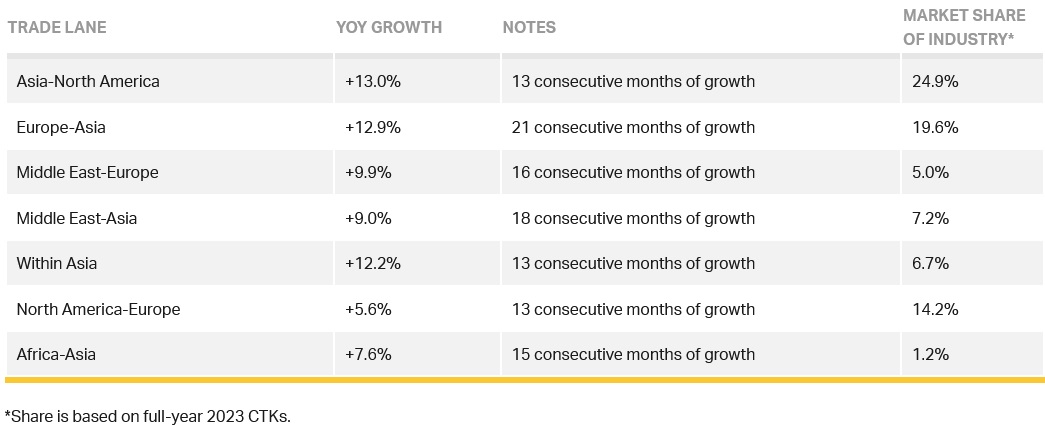

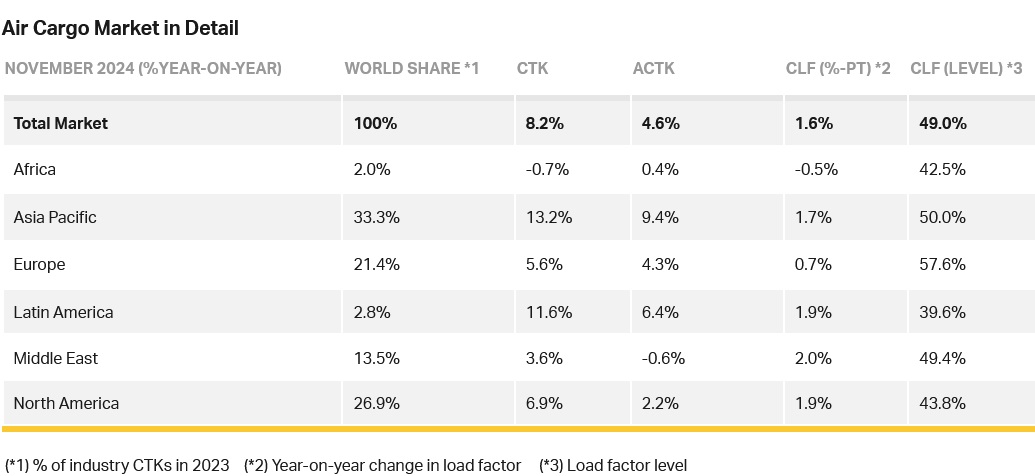

IATA data showed that total demand, measured in cargo tonne-kilometres (CTK), rose by 8.2% compared to November 2023 levels (9.5% for international operations) for a 16th consecutive month of growth. Capacity, measured in available cargo tonne-kilometres (ACTK), increased by 4.6% compared to November 2023 (6.5% for international operations).

Walsh said: "It was a good November for air cargo with 8.2% demand growth nearly doubling the 4.6% growth in cargo capacity. Fuel costs tracked at 22% below previous-year levels and tight market conditions supported yield growth at 7.8%. All things considered we are looking to close out 2024 air cargo performance on a profitable note. While this strong performance is very likely to extend into 2025, there are some downside risks that must be carefully watched. These include inflation, geopolitical uncertainties and trade tensions."

Operating environment factors:

- Year-on-year, industrial production rose 2.1% in October. Global goods trade grew for a seventh consecutive month, reporting a 1.6% increase.

- The Purchasing Managers Index (PMI) for global manufacturing output was above the 50-mark for November, indicating growth. However, the PMI for new export orders remained below the 50-mark, suggesting ongoing uncertainty and weakness in global trade.

- US headline inflation, based on the annual Consumer Price Index (CPI), rose by 0.1 percentage points to 2.7% in November. In the same month, the inflation rate in the EU increased by 0.2 percentage points to 2.5%. China’s consumer inflation fell to 0.2% in November, continuing concerns of an economic slowdown.

November Regional Performance

Asia-Pacific airlines saw 13.2% year-on-year demand growth for air cargo in November, the strongest growth among the regions. Capacity increased by 9.4% year-on-year.

North American carriers saw 6.9% year-on-year demand growth for air cargo in November. Capacity increased by 2.2% year-on-year.

European carriers saw 5.6% year-on-year demand growth for air cargo in November. Capacity increased 4.3% year-on-year.

Middle Eastern carriers saw 3.6% year-on-year demand growth for air cargo in November. Capacity decreased by 0.6% year-on-year.

Latin American carriers saw 11.6% year-on-year demand growth for air cargo in November. Capacity increased 6.4% year-on-year.

African airlines saw a 0.7% year-on-year decrease in demand for air cargo in November, the slowest among regions. Capacity increased by 0.4% year-on-year.

Trade Lane Growth: International routes experienced exceptional traffic levels for the 16th consecutive month with a 9.5% year-on-year increase in November. Airlines are benefiting from rising e-commerce demand in the US and Europe amid ongoing capacity limits in ocean shipping.