Seraphim Space maps space sector trends

Image courtesy Seraphim Space

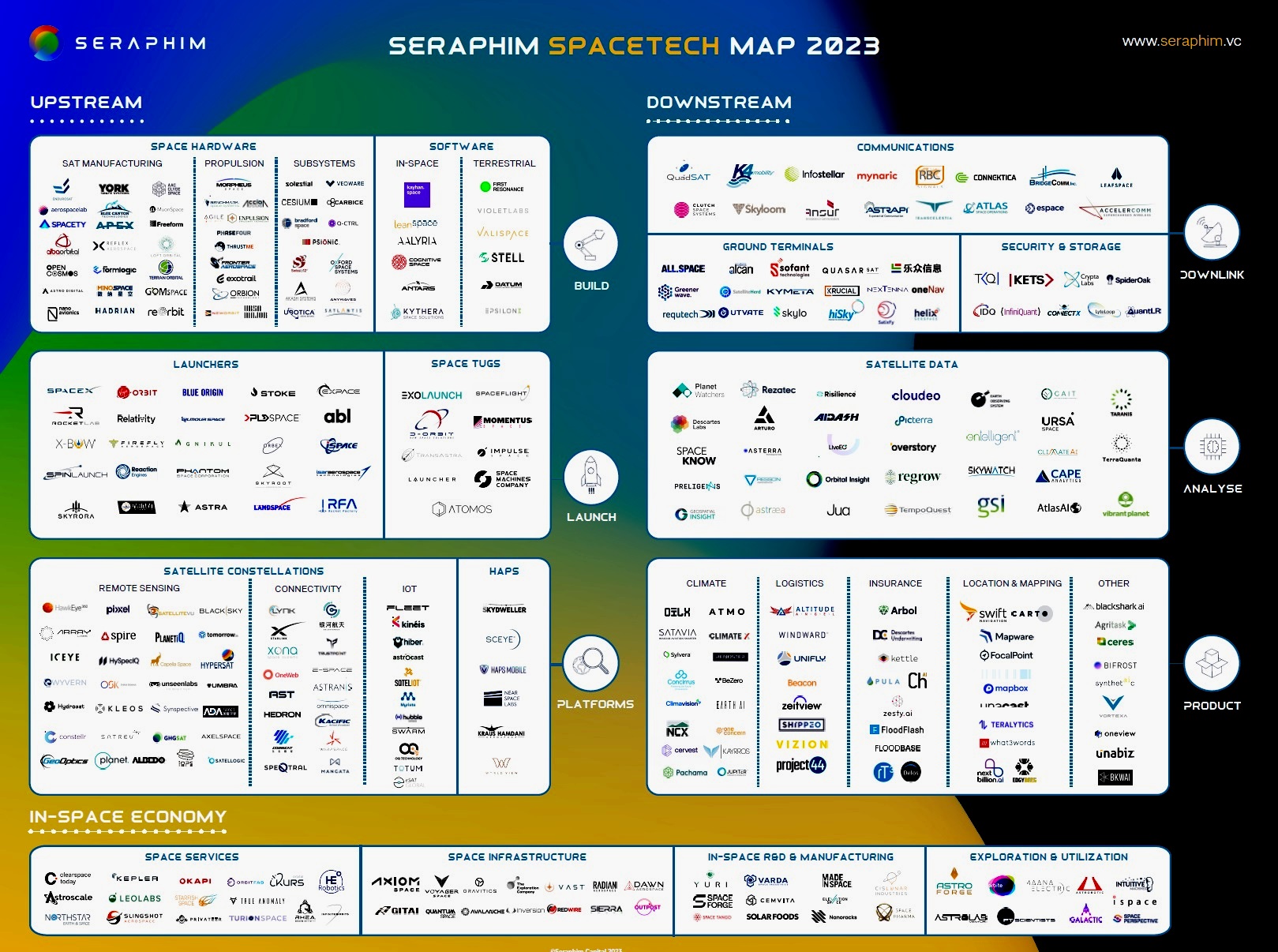

The space industry has been going through a major transformation in recent years. The ecosystem map looks to capture companies across the SpaceTech value chain, upstream, downstream and the In-Space economy.

Seraphim Space has sought to include the most progressed venture-backed 'New Space' startups in its map.

This year, 333 companies are represented on the map, with around 50% US based. However, the map includes SpaceTech companies from 29 countries globally, showing that NewSpace is a global phenomenon. The top geographies represented include US, UK, Germany, France, China, Japan, Israel and Singapore.

Product

Many new product businesses have been founded in recent years and these businesses are all addressing different global challenges. Most of the additions on the downstream this year were to the product category. Seraphim Space have therefore split this section up into the major themes it sees these platforms addressing - climate, insurance and logistics.

The climate is no doubt one of the most populated segments, as this theme is critical to the future of humanity and many entrepreneurs have identified crucial gaps in this market.

Notably, most of the product climate-focused companies were companies in the UK. The UK is beginning to emerge as a leader in climate tech and this trend is seen strongly amongst SpaceTech companies too.

Build

The Build market is split into two key categories, hardware & software. The hardware segment is more mature and represents companies that have been providing the hardware layer enabling new space, often for many years. The companies represented within the Software segment are generally at a much earlier stage, with none represented beyond Series A. The recent expansion in the number of companies providing software to space companies shows that founders have identified a meaningful market opportunity, within satellite operators and manufacturers alone. There are now sufficient numbers of startups acting in this segment to warrant its own sub-category.

Launch

The launch segment remains relatively stable, yet there is increasing activity in the SpaceTug segment. Seraphim Space believe Orbital Test Vehicles (OTVs) will become increasingly important as Starship and other heavily lift capability come online. Rideshare satellites do not have the luxury of dictating their orbits. OTVs provide the ideal solution, allowing all satellites to arrive at their planned orbits, while enjoying the improved economics of the larger launch vehicles.

Platforms

In the satellite constellations segment, IoT has been separated into its own distinct segment to better differentiate between the type of offering and end markets that each type of constellation is targeting. Low-cost IoT connectivity is exciting as it has the potential to revolutionise the reaching of IoT, impacting agriculture and logistics in particular.

In-space economy

Following its deep dive into the in-space economy, Seraphim Space have brought the in-space economy segment into alignment with the taxonomies from the previous map. It has condensed segments as required and only represented what it views as the most progressed startups within this field. This year contains the most companies ever recorded in this segment at 51.

Downstream

Across downstream in general, there were four new additions from Singapore. The SpaceTech sector in Singapore is flourishing and while Seraphim Space have generally seen more upstream/hardware SpaceTech companies in Asia, this trend now appears to be shifting to a similar dynamic seen in the West where improving AI and analytics capabilities are leading to a surge in analyse and product companies in these regions.

Analyse

There were also many new additions in the analyse segment. This is unsurprising following an explosion in earth observation data thanks to maturing EO satellite constellations. This trend has also been reflected in the amount of funding the analyse segment has received, which, according to Seraphim Space's most recent Space Index, was one of the most resilient segments in the recent investment downturn.