September sees continuing strong global passenger and air cargo demand

Image courtesy IATA

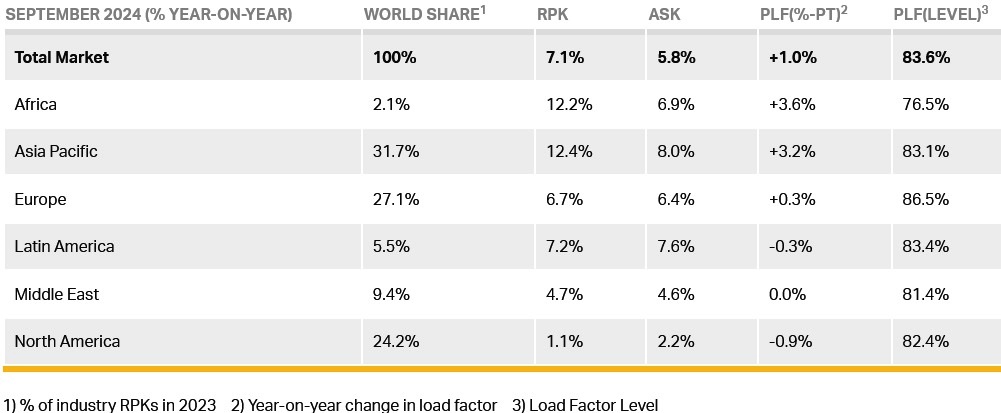

Total demand, measured in revenue passenger kilometres (RPK), was up 7.1% compared to September 2023, an all-time high for September. Total capacity, measured in available seat kilometres (ASK), was up 5.8% year-on-year. The September load factor was 83.6% (+1.0ppt compared to September 2023).

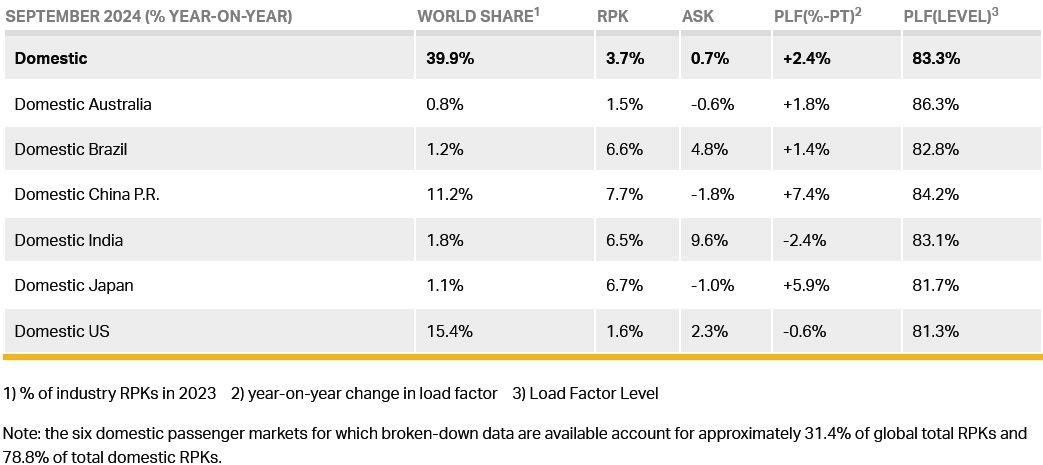

International demand rose 9.2% compared to September 2023. Capacity was up 9.1% year-on-year and the load factor rose to 83.8% (+0.1ppt compared to September 2023). At the same time, domestic demand rose 3.7% compared to September 2023, with capacity up 0.7% year-on-year and the load factor was 83.3% (+2.4ppt compared to September 2023).

Willie Walsh (above), IATA’s Director General said: “The year’s peak travel season ended with demand at an all-time high. This is good news not just for passengers but also for the global economy. Every flight creates more jobs and trade. But the air travel success story is bringing challenges. We will soon face a capacity crunch in some regions which threatens to curtail these economic and social benefits. Government’s will face a choice: lose out to more dynamic nations who value global connectivity, or forge a consensus for sustainable growth.

"Airlines are making significant investments to achieve net zero carbon emissions by 2050. That needs to be accompanied by an equally active political vision, backed-up by actions, to ensure we have efficient and sufficient airport and air traffic management capacity to meet the needs of citizens and businesses to travel.”

Air Passenger Market in Detail

Regional Breakdown - International Passenger Markets

All regions showed growth for international passenger markets in September 2024 compared to September 2023. Load factor was a mixed bag: Europe had the highest load factors, and Asia and African carriers also improved, but the Americas and the Middle East suffered falls.

Asia-Pacific airlines achieved an 18.5% year-on-year increase in demand. Capacity increased 17.7% year-on-year and the load factor was 82.6% (+0.5ppt compared to September 2023).

European carriers saw a 7.6% year-on-year increase in demand. Capacity increased 7.4% year-on-year, and the load factor was 85.9% (+0.2ppt compared to September 2023).

Middle Eastern carriers saw a 4.4% year-on-year increase in demand. Capacity increased 4.6% year-on-year and the load factor was 81.4% (-0.1ppt compared to September 2023).

North American carriers saw a 0.5% year-on-year increase in demand. Capacity increased 1.9% year-on-year, and the load factor was 84.4% (-1.1 ppt compared to September 2023).

Latin American airlines saw a 12.4% year-on-year increase in demand. Capacity climbed 13.9% year-on-year. The load factor was 84.3% (-1.1ppt compared to September 2023).

African airlines saw an 11.9% year-on-year increase in demand. Capacity was up 6.6% year-on-year. The load factor rose to 76.0% (+3.6ppt compared to September 2023).

Domestic Passenger Markets

All key markets, showed stable growth in domestic demand and all except Japan saw all-time highs for September domestic traffic.

Air Cargo

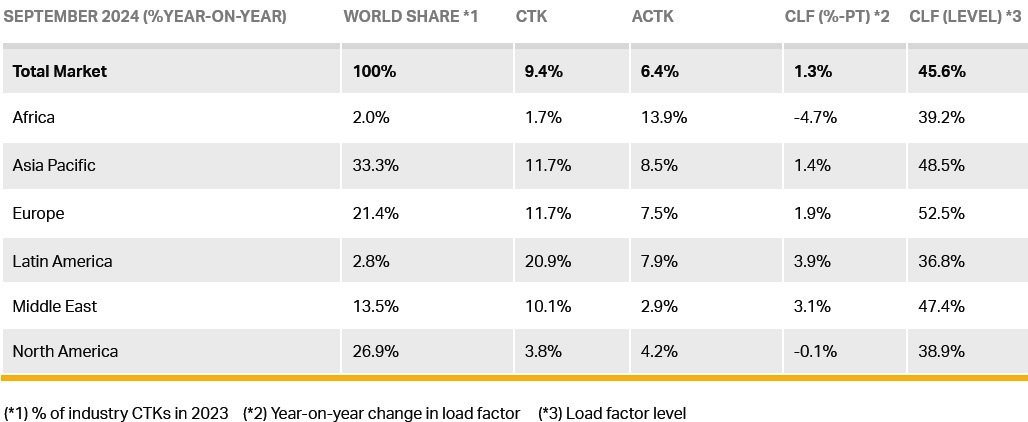

For September 2024 global air cargo markets IATA data showed continuing strong annual growth in demand, with total demand, measured in cargo tonne-kilometres (CTKs), rising by 9.4% compared to September 2023 levels (10.5% for international operations) for a 14th consecutive month of growth.

Capacity, measured in available cargo tonne-kilometres (ACTKs), increased by 6.4% compared to September 2023 (8.1% for international operations). This continued to be largely related to the growth in international belly capacity, which rose 10.3%--extending the trend of double-digit annual capacity growth to 41 consecutive months.

Willie Walsh said: “September performance brought continued good news for air cargo markets. With 9.4% year-on-year growth, cargo volumes continued to mark all-time highs for demand. Yields are also improving, up 11.7% on 2023 and 50% above 2019 levels. All this points to a strong finish for this year. For longer-term trends, the air cargo world will be closely following the outcome of the US election for indications of how US trade policy will evolve.”

Several factors in the operating environment should be noted:

- Year-on-year, industrial production rose 1.6% while global goods trade increased 2.8% for a sixth consecutive month of growth. Monthly trade grew by 1.4%, the highest in seven months.

- The Purchasing Managers Index (PMIs) for global manufacturing output, and the PMI for new export orders, were both below the 50-mark at 49.4 and 47.5 respectively, indicating contraction.

- US headline inflation, based on the annual Consumer Price Index (CPI), declined by 0.2 percentage points to 2.4% in September, marking the seventh straight month of easing inflation. In the same month, the inflation rate in the EU fell by 0.3 percentage points to 2.1%, continuing a process started in January 2023. China’s consumer inflation remained low at 0.4% in September amid concerns of an economic slowdown.

Air Cargo Market in Detail

September Regional Performance

Asia-Pacific airlines saw 11.7% year-on-year demand growth for air cargo in September. Capacity increased by 8.5% year-on-year.

North American carriers saw 3.8% year-on-year demand growth for air cargo in September. Capacity increased by 4.2% year-on-year.

European carriers saw 11.7% year-on-year demand growth for air cargo in September. Capacity increased 7.5% year-on-year.

Middle Eastern carriers saw 10.1% year-on-year demand growth for air cargo in September. Capacity increased 2.9% year-on-year.

Latin American carriers saw 20.9% year-on-year demand growth for air cargo in September, the strongest growth among the regions. Capacity increased 7.9% year-on-year.

African airlines saw 1.7% year-on-year demand growth for air cargo in September, the slowest among regions. September capacity increased by 13.9% year-on-year.

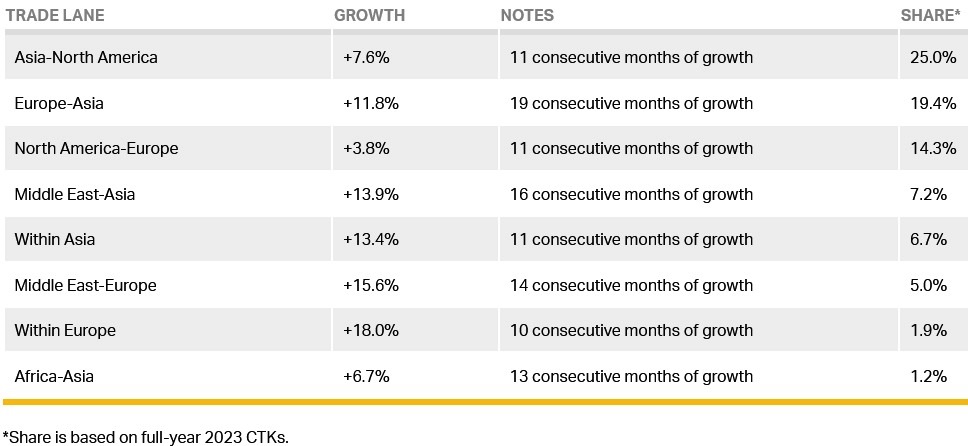

Trade Lane Growth: International routes experienced exceptional traffic levels for a fifth month, with a 10.5% year-on-year increase in September. Airlines are benefiting from rising e-commerce demand in the US and Europe amid ongoing capacity limits in ocean shipping.