ITSA sees positive start to 2025 for UK connector market

Image courtesy ITSA

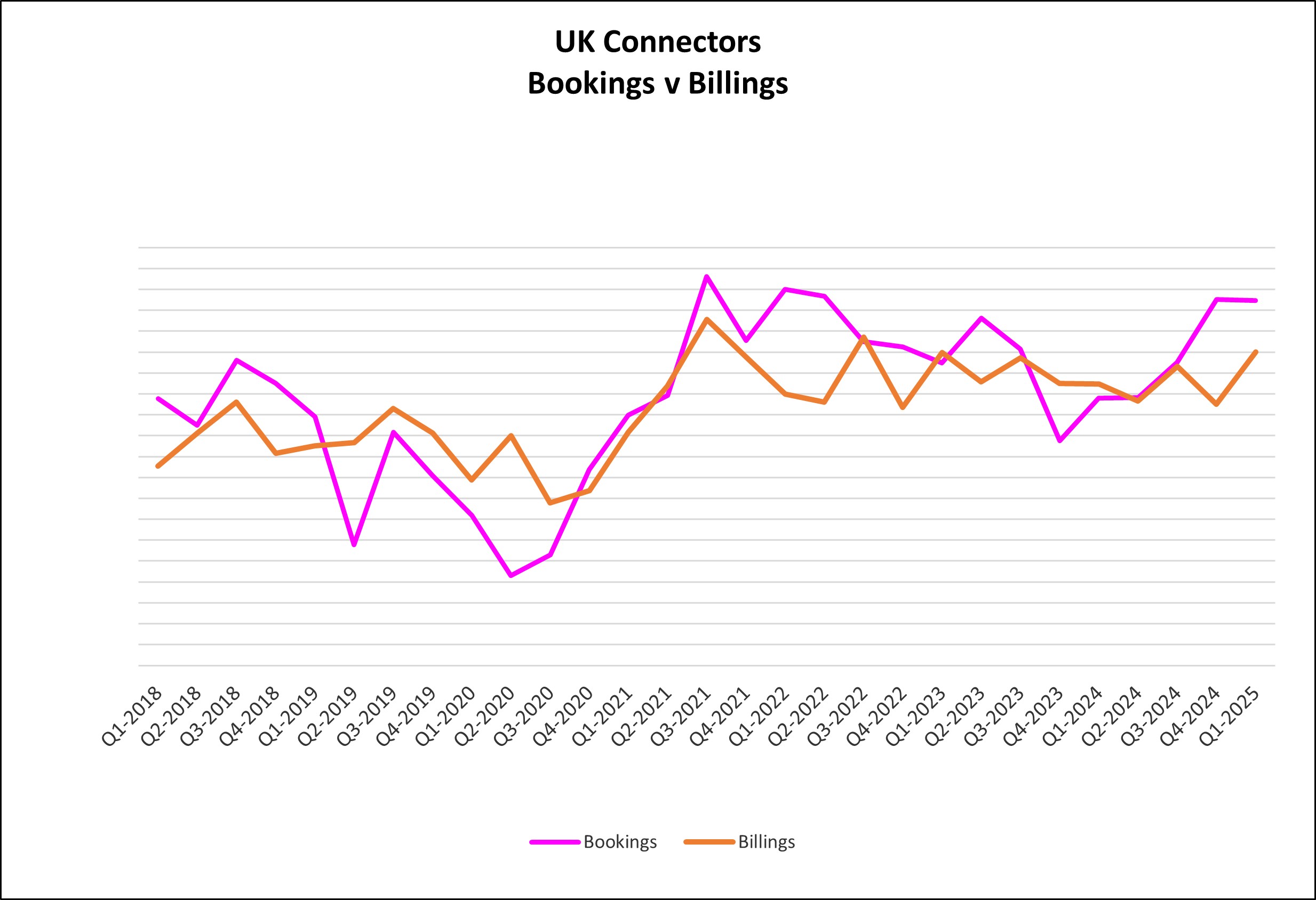

Although the quarter has been surprisingly positive, statistics were compiled prior to the market disruption relating to the US trade tariff announcements, yet members remain cautiously optimistic for 2025. Orders have stayed positive with Book-to-Bill at 1.10 but were flat versus Q4 of 2024.

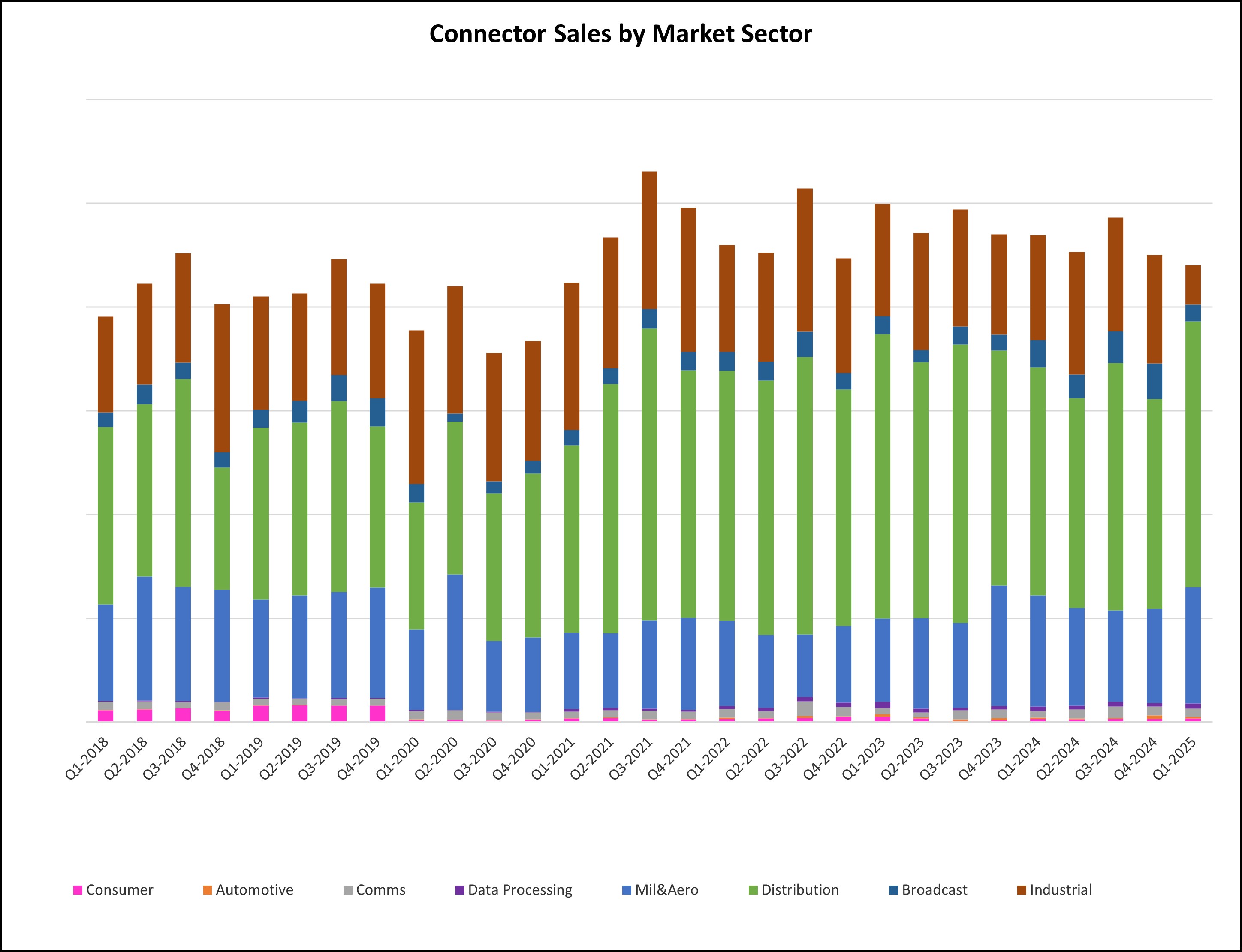

The aerospace and defence (military/aero) sector saw 24% growth, in anticipation of increased defence spending, whilst Mass Transport and Data Processing both saw significant increases, due to major projects.

Headline results:

- Order intake in Q1 of 2025 was the second highest since Q2 of 2022

- There were some marked variations in market performance.

- Mass Transport up 71% (linked to key rolling stock & infrastructure projects)

- Data Processing saw a jump of 52% (on key datacentre projects).

- Distribution significantly up 21%

- Medical up 9%

- Communication down 9%

- Test & Msmnt down 14% (now falling for two consecutive quarters)

- Broadcast down 16% (against a backdrop of significant spend in 2024).

The impact of significant tariffs being imposed by the US on the rest of the world is definitely not reflected in the data yet, however, we have already seen a significant increase in defence spending, reflecting both the continuing war in Ukraine and probably some pre-emptive spending anticipating that Europe is going to have focus more on defence.

The second quarter is likely to be a far more accurate picture of business levels for the near future and members are naturally extremely cautious. Nevertheless, the level of RFP’s etc carried into 2025 has helped in holding up Q1 and with a current positive Book-to-Bill there are some faint signs of hope.

To download a full copy of the ITSA Report click here

For further information: https://itsa.org.uk