ITSA reports UK connector market steady in 2024

Image courtesy ITSA

Orders were steady, with some market sectors, such as aerospace and defence (military/aero) seeing gains over the past 12 months. Aerospace and defence (military/aero) was 4% up, pulling back from 16% up in Q3 but RFQ’s remain high.

ITSA UK connector market Year End 2024

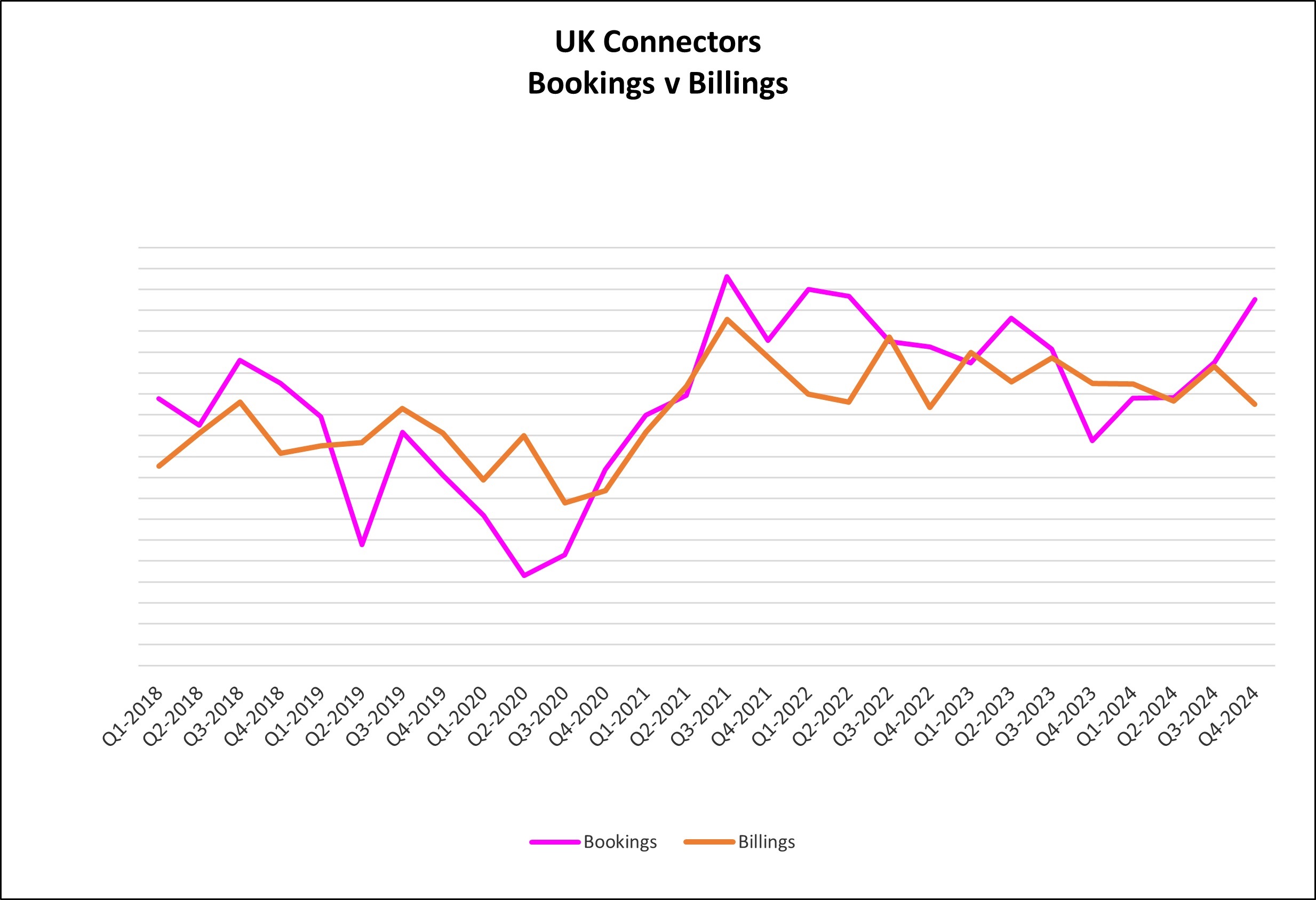

Members report sales 4% down over 2023. Orders were positive with B to B at 1.05:1, due to the high order intake in Q4.

Headline performances: -

- Revenues down -4% yoy and orders up 2% yoy

- Order intake in Q4 of 2024 was the highest since Q2 of 2022

- B to B became positive at 1.05:1 due primarily to the high order intake in Q4

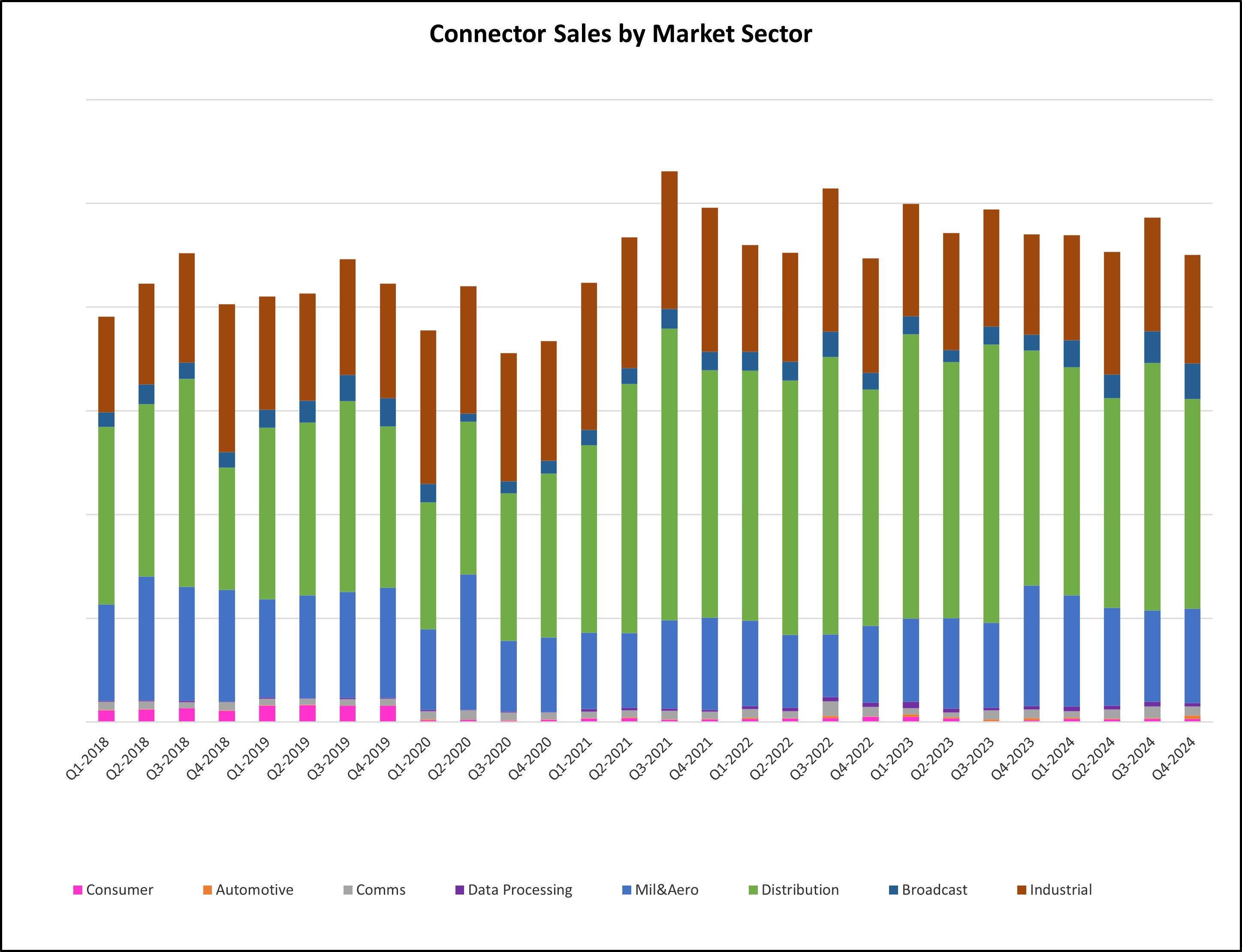

- Markets continue to perform variably.

Markets:

- Broadcast up 83%

- Mil/Aero 4% (this is a significant drop as it was up 16% at the end of Q3)

- Medical 48%

- Communication 29%

- T&M down 17%

- Mass Transport down 13%

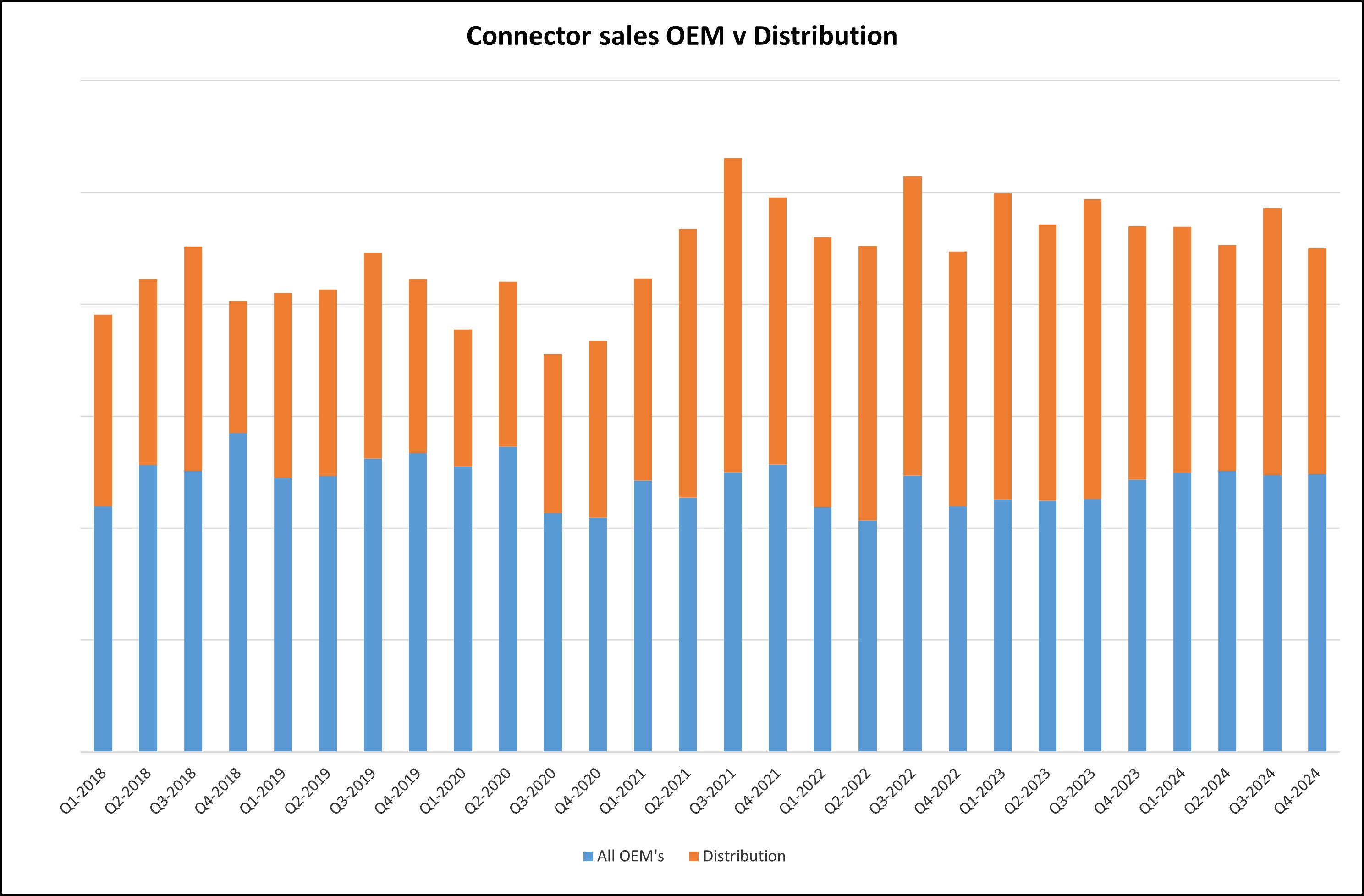

Distribution continues to be weak as it is down 15%. This should be taken in context as Distribution represents 46% of ITSA's members sales.

Overall Members reported a reduction in YoY revenues of -4% but in some areas members experienced up to -30% depending on technology and markets, despite the low single-digit drop all members expressed concern about the markets in 2024 and all faced significant challenges.

It seems that distributors have been destocking, hence the poor distributor revenues of -15% and it would appear that customers had held off placing orders until the budget, it would also appear that customers had decided to use the fourth quarter of 2024 to place the held orders hence the jump in member order intake.

ITSA reports that although the level of new RFPs seems to be high and some key projects are rolling into 2025, this is only masking ITSA members' concerns over prospects in 2025.

Members are facing a huge number of challenges, such as customer bad debt issues are increasing, recruitment of key skills remains a critical challenge, the increase in employer NI costs, increase in the minimum wage and the change to employee rights all conspire to make some of our membership more pessimistic about 2024.

All these issues are impacting costs and members will be trying to get price increases where possible. Some members suggested that with the rise in NI costs some may have to offer reduced pay increases and freeze recruitment, this was obviously based on the scale of their UK operations, even improvements in productivity will only go part way to recovering the additional costs.

It seems 2025 is looking like a year of caution with most ITSA members expecting flat revenues and if any growth is achieved it will be extremely low single digit.

A lot of members have business elsewhere such as the US, which appears to be quite strong at the moment of writing and Europe where it seems Germany and some other areas of Europe are really struggling.

Summary

At the exit of 2024 ITSA held a round table 'State of the Nation' meeting to get the views of its members on the impact of the governments budget plus other global issues facing the UK connector market.

It is obvious that 2024 was a challenge, particularly in the last quarter but, has as been seen historically, the UK connector market held up well. Members reported continuing variations in market performances, which has made it exceedingly difficult to plan and forecast for investments.

Following the government budget in the last quarter all ITSA members had to rethink how they saw 2025 developing and although there are some positive market signs, the extra cost burdens they are facing with the NI increase and minimum wage uplift, together with increases in material costs, has meant that recruitment in particular and planned salary increases are all being scaled back.

ITSA members have bucked the trend in the past and this may well be the case in 2025.

Download a full copy of the ITSA Report

For further information: https://itsa.org.uk