IATA releases August passenger and cargo data

Image courtesy IATA

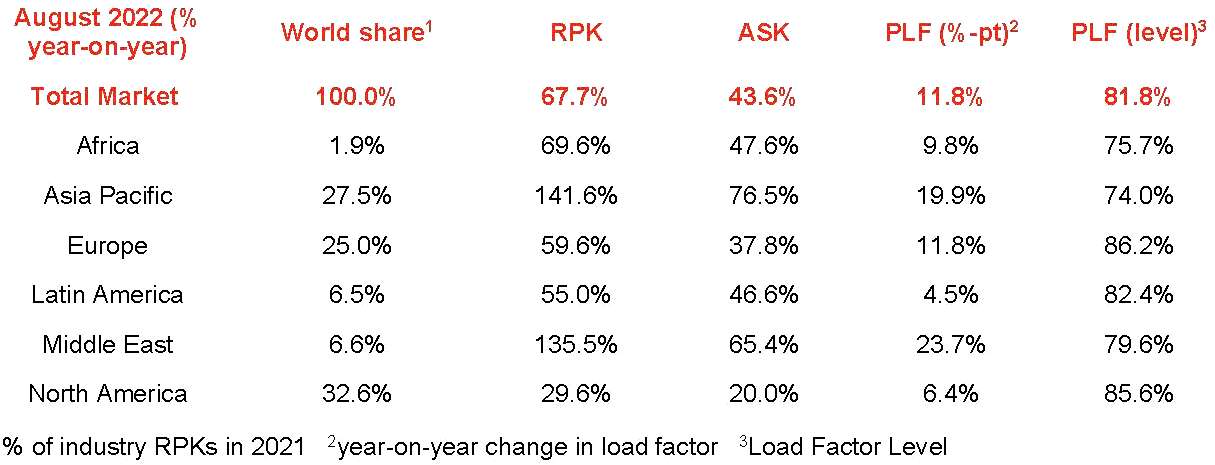

Total traffic in August 2022 (measured in revenue passenger kilometres or RPKs) was up 67.7% compared to August 2021. Globally, traffic is now at 73.7% of pre-crisis levels.

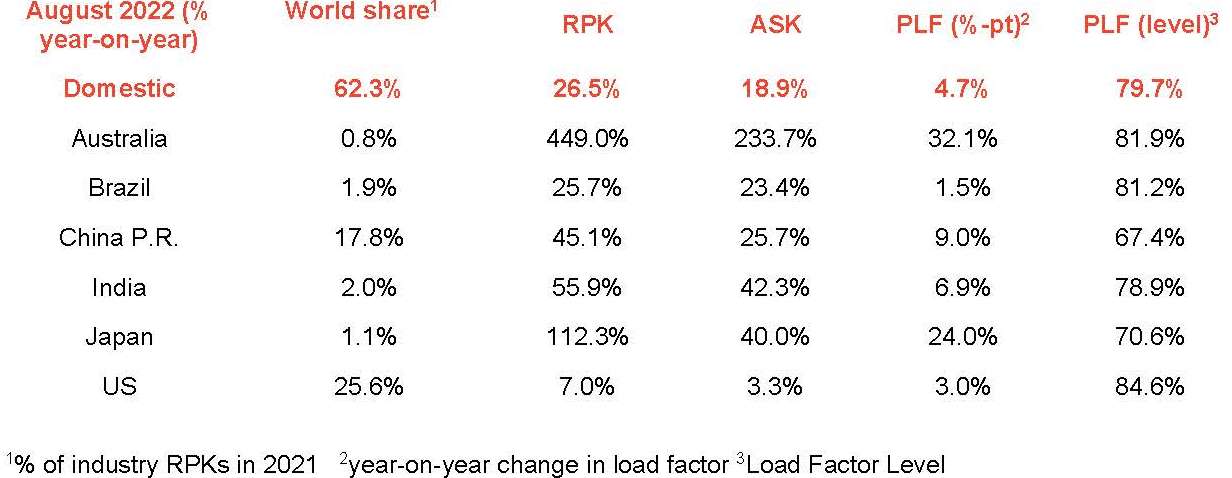

Domestic traffic for August 2022 was up 26.5% compared to the year-ago period. Total August 2022 domestic traffic was at 85.4% of the August 2019 level.

International traffic rose 115.6% versus August 2021 with airlines in Asia delivering the strongest year-over-year growth rates. August 2022 international RPKs reached 67.4% of August 2019 levels.

Willie Walsh (above), IATA’s Director General said: “The Northern Hemisphere peak summer travel season finished on a high note. Considering the prevailing economic uncertainties, travel demand is progressing well. And the removal or easing of travel restrictions at some key Asian destinations, including Japan, will certainly accelerate the recovery in Asia. The mainland of China is the last major market retaining severe COVID-19 entry restrictions.”

International Passenger Markets

- Asia-Pacific airlines had a 449.2% rise in August traffic compared to August 2021. Capacity rose 167.0% and the load factor was up 40.1 percentage points to 78.0%. While the region experienced the strongest year-over-year growth, remaining travel restrictions in China continue to hamper the overall recovery for the region.

- European carriers’ August traffic climbed 78.8% versus August 2021. Capacity rose 48.0%, and load factor increased 14.7 percentage points to 85.5%. The region had the second highest load factor after North America.

- Middle Eastern airlines’ traffic rose 144.9% in August compared to August 2021. Capacity rose 72.2% versus the year-ago period, and load factor climbed 23.7 percentage points to 79.8%.

- North American carriers saw a 110.4% traffic rise in August versus the 2021 period. Capacity rose 69.7%, and load factor climbed 16.9 percentage points to 87.2%, which was the highest among the regions.

- Latin American airlines’ August traffic rose 102.5% compared to the same month in 2021. August capacity rose 80.8% and load factor increased 8.9 percentage points to 83.5%.

- African airlines experienced a 69.5% rise in August RPKs versus a year ago. August 2022 capacity was up 45.3% and load factor climbed 10.8 percentage points to 75.9%, the lowest among regions. International traffic between Africa and neighboring regions is close to pre-pandemic levels.

Domestic Passenger Markets

- Australia’s domestic traffic posted a 449.0% year-over-year increase and is now 85.8% of 2019 levels.

- US domestic traffic was up 7.0% in August, compared to August 2021. Further recovery is limited by supply constraints.

This week marks a year since the IATA AGM took the historic decision to achieve net zero carbon emissions by 2050. Walsh said: “Aviation is committed to decarbonising by 2050, in line with the Paris agreement. Also the energy transition required to achieve this must be supported by government policies. That is why there is such great anticipation for the 41st Assembly of the International Civil Aviation Organization to reach agreement on a Long-Term Aspirational Goal on aviation and climate change. The near grounding of aviation during the pandemic highlighted how important aviation is to the modern world. And we will take a giant step towards securing the long-term social and economic benefits of sustainable global connectivity, if the policy-vision of governments is aligned with the industry’s commitment to net zero by 2050.”

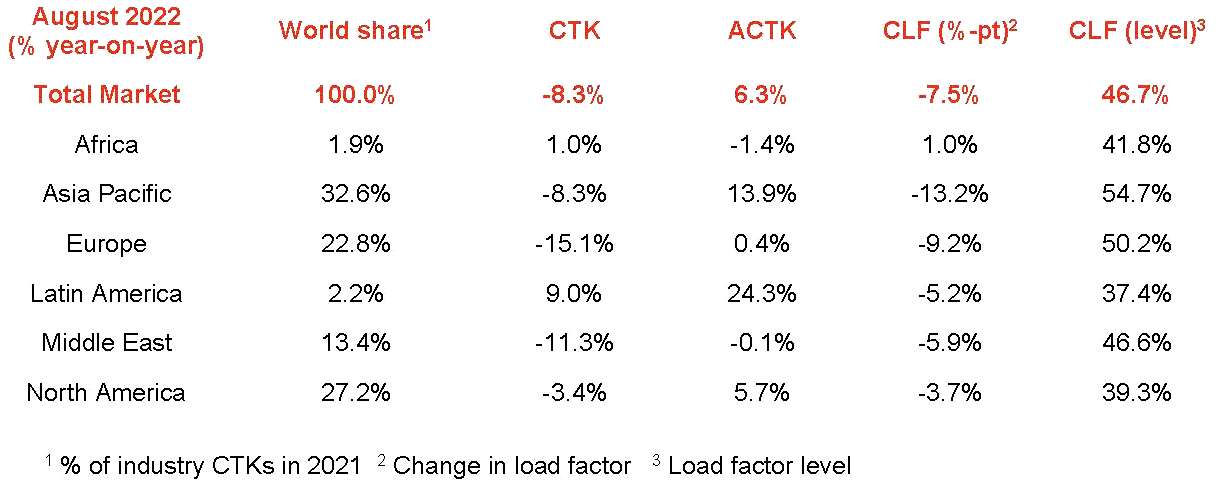

Global air cargo markets

Data for global air cargo markets demonstrate the industry’s resilience amid economic uncertainties.

Global demand, measured in cargo tonne-kilometres (CTKs*), fell 8.3% compared to August 2021 (-9.3% for international operations). This was a slight improvement on the year-on-year decline of 9.7% seen in July.

Capacity was 6.3% above August 2021 (+6.1% for international operations). This is a significant expansion over the 3.6% year-on-year increase in July.

Several factors should be noted in the operating environment:

- Global goods trade expanded slightly in August and the additional easing of COVID-19 restrictions in China will positively impact cargo markets. While maritime will be the main beneficiary, air cargo will also receive a boost from these developments.

- Inflation levels in G7 countries slowed for the first time since November 2020.

- Oil prices stabilised in August and the jet fuel crack spread fell from a peak in June.

- New export orders, a leading indicator of cargo demand and world trade, decreased in leading economies in all regions except the US.

“Air cargo continues to demonstrate resilience. Cargo volumes, while tracking below the exceptional performance of 2021, have been relatively stable in the face of economic uncertainties and geopolitical conflicts. Market signals remain mixed. August presented several indicators with upside potential: oil prices stabilised, inflation slowed and there was a slight expansion in goods traded globally. But the decrease in new export orders in all markets except the US tells us that developments in the months ahead will need to be watched carefully,” said Willie Walsh.

August Regional Performance

- Asia-Pacific airlines airlines saw their air cargo volumes decrease by 8.3% in August 2022 compared to the same month in 2021. This was an improvement over the 9.0% decline in July. Airlines in the region benefited from slightly increased levels of trade and manufacturing activity due to the easing of COVID-19 restrictions in China. Available capacity in the region increased 13.9% compared to August 2021, a significant increase over the 2.7% growth in July.

- North American carriers posted a 3.4% decrease in cargo volumes in August 2022 compared to the same month in 2021. This was an improvement over the 5.7% decline in July. The lifting of restrictions in China improved demand and a further boost is expected in the coming months. Capacity was up 5.7% compared to August 2021.

- European carriers saw a 15.1% decrease in cargo volumes in August 2022 compared to the same month in 2021. This was the worst performance of all regions for the fourth month in a row. This is attributable to the war in Ukraine. Labor shortages and high inflation levels, most notably in Turkey, also affected volumes. Capacity increased 0.4% in August 2022 compared to August 2021.

- Middle Eastern carriers experienced an 11.3% year-on-year decrease in cargo volumes in August. Stagnant cargo volumes to/from Europe impacted the region’s performance. Capacity was down 0.1% compared to August 2021.

- Latin American carriers reported an increase of 9.0% in cargo volumes in August 2022 compared to August 2021. This was the strongest performance of all regions. Airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months. Capacity in August was up 24.3% compared to the same month in 2021.

- African airlines saw cargo volumes increase by 1.0% in August 2022 compared to August 2021. This was a significant improvement on growth recorded the previous month (-3.5%). Capacity was 1.4% below August 2021 levels.