Global air passenger and cargo demand reached record highs in 2024

Image courtesy IATA

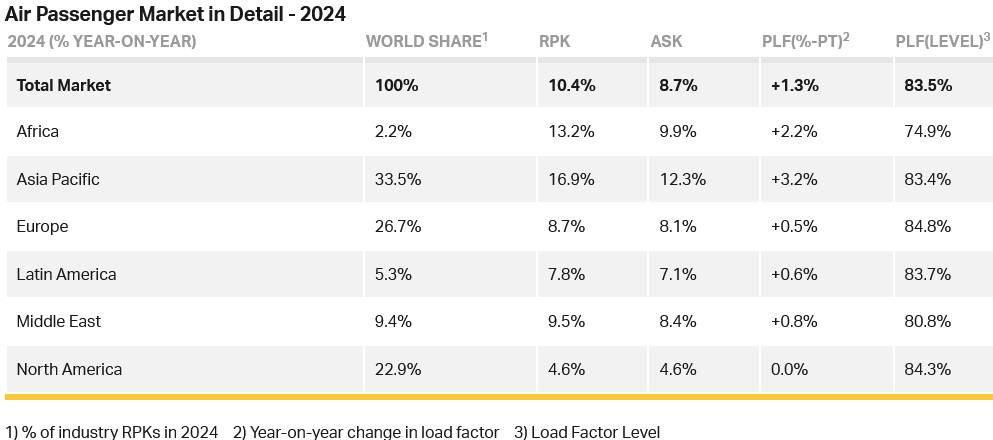

Total full-year traffic in 2024 (measured in revenue passenger kilometres or RPKs) rose 10.4% compared to 2023. This was 3.8% above pre-pandemic (2019) levels. Total capacity, measured in available seat kilometres (ASK), was up 8.7% in 2024. The overall load factor reached 83.5%, a record for full-year traffic.

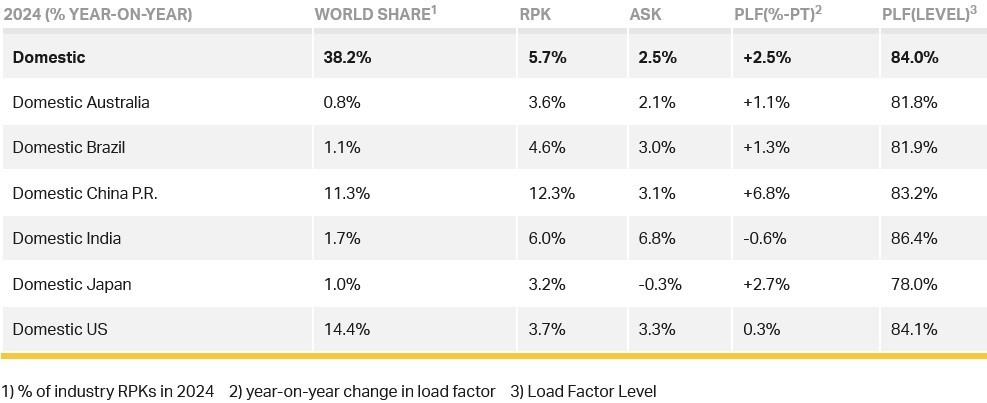

International full-year traffic in 2024 increased 13.6% compared to 2023, and capacity rose 12.8%, whilst domestic full-year traffic for 2024 rose 5.7% compared to the prior year and capacity expanded by 2.5%.

December 2024 was a strong finish to the year with overall demand rising 8.6% year-on-year and capacity grew by 5.6%. International demand rose by 10.6% and domestic demand by 5.5%. The December load factor reached 84%, a record for the month.

Willie Walsh (above), IATA’s Director General, said: “Twenty twenty-four made it absolutely clear that people want to travel. With 10.4% demand growth, travel reached record numbers domestically and internationally. Airlines met that strong demand with record efficiency. On average, 83.5% of all seats on offer were filled—a new record high, partially attributable to the supply chain constraints that limited capacity growth. Aviation growth reverberates across societies and economies at all levels through jobs, market development, trade, innovation, exploration and much more.”

“Looking to 2025, there is every indication that demand for travel will continue to grow, albeit at a moderated pace of 8.0% that is more aligned with historical averages. The desire to partake in the freedom that flying makes possible brings some challenges into sharp focus. First, the tragic accident in Washington last night reminds us that safety needs our continuous efforts. Our thoughts are with all those affected. We will never cease our work to make aviation ever safer.

"Second is the airlines’ firm commitment to achieve net zero carbon emissions by 2050. While airlines invested record amounts in purchases of Sustainable Aviation Fuel (SAF) in 2024, less than 0.5% of fuel needs were meet with SAF. SAF is in short supply and costs must come down. Governments could fortify their national energy security and unblock this problem by prioritizing renewable fuel production from which SAF is derived. In addition to securing energy supplies and increasing the SAF supply, diverting a fraction of the subsidies given for fossil fuel extraction to support renewable energy capacity would also boost prosperity through economic expansion and job creation.”

International Passenger Markets

Full-year international traffic surpassed the previous 2019 high by 0.5% in 2024, with growth in all regions. Capacity was 0.9% lower than 2019. The load factor improved by 0.5 percentage points, finishing on 83.2%, a record high.

For the month of December, international demand grew by 10.6%, capacity increased 7.7% and the load factor improved by 2.2 percentage points (compared to December 2023) to 83.9%.

Asia-Pacific airlines posted a 26.0% rise in full year international 2024 traffic compared to 2023, maintaining the strongest year-over-year rate among the regions. Capacity rose 24.7% and the load factor climbed 0.8 percentage points to 83.8%. Despite this strong growth, opportunities for further growth remain high, as international RPKs remain 8.7% below 2019 levels. December 2024 traffic rose 17.1% compared to December 2023.

European carriers’ full year traffic climbed 9.7% versus 2023. Capacity increased 9.2% and load factor rose 0.4 percentage points to 84.1%. For December, demand climbed 8.6% compared to the same month in 2023.

Middle Eastern airlines saw a 9.4% traffic rise in 2024 compared to 2023. Capacity increased 8.4% and load factor climbed 0.7 percentage points to 80.8%. December demand climbed 7.7% compared to the same month in 2023.

North American carriers reported a 6.8% annual traffic rise in 2024 compared to 2023. Capacity increased 7.4%, and load factor fell -0.5 percentage points to 84.2%. December 2024 traffic rose 5.1% compared to the year-ago period.

Latin American airlines posted a 14.4% traffic rise in 2024 over full year 2023. Annual capacity climbed 14.3% and load factor increased 0.1 percentage points to 84.8%, the highest among the regions. December demand climbed 11.3% compared to December 2023.

African airlines’ annual traffic rose 13.2% in 2024 versus the prior year. Full year 2024 capacity was up 9.5% and load factor climbed 2.5 percentage points to 74.5%, the lowest among regions but a record high for Africa. December 2024 traffic for African airlines rose 12.4% over December 2023.

Domestic Passenger Markets

Domestic full-year demand reached record highs for passenger numbers and load factors. The standout performer for 2024 Domestic RPK was once again China, which increased 12.3% over 2023. There was stable growth across other major domestic markets. To note, Japan achieved 3.2% growth while capacity contracted by 0.3%. Only India had a fall in load factor (-0.6 %-pt) but still achieved a load factor of 86.4%—the highest among all domestic markets.

Air Cargo

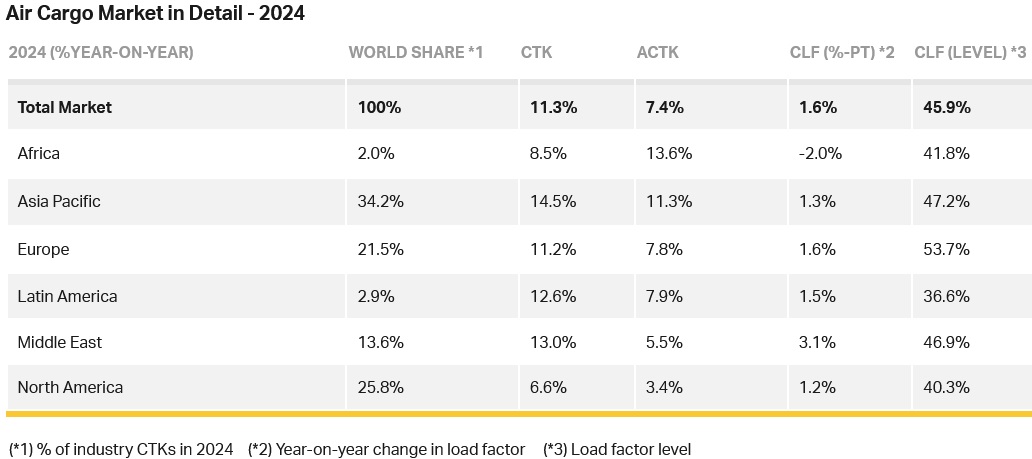

IATA data for full year 2024 and December 2024 global air cargo market performance showed full-year demand for 2024, measured in cargo tonne-kilometres (CTK), increased 11.3% (12.2% for international operations) compared to 2023. Full-year 2024 demand exceeded the record volumes set in 2021.

Full-year capacity in 2024, measured in available cargo tonne-kilometres (ACTK), increased by 7.4% compared to 2023 (9.6% for international operations) and full-year yields averaged 1.6% lower than 2023 but 39% higher than in 2019.

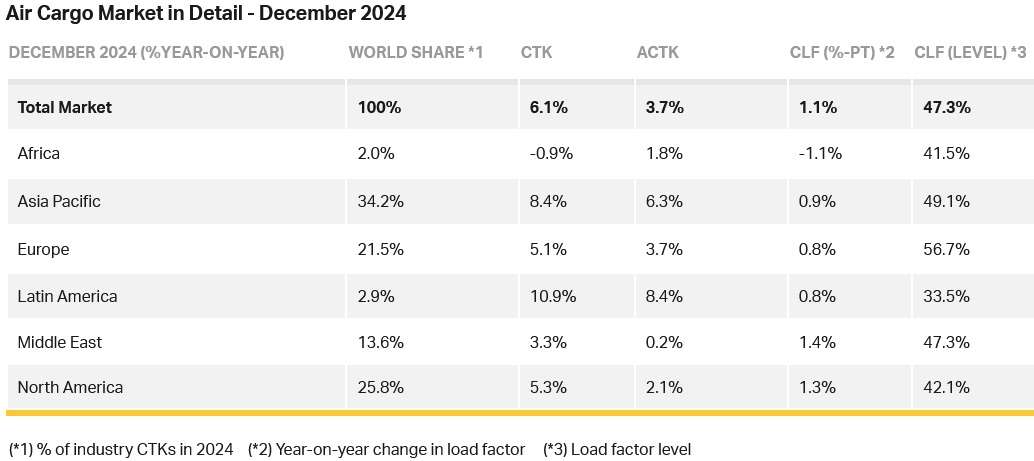

December 2024 brought the year to a close with continued strong performance. Global demand was 6.1% above December 2023 levels (7.0% for international operations). Global capacity was 3.7% above December 2023 levels (5.2% for international operations). Cargo yields were 6.6% higher than December 2023 (and 53.4% higher than in December 2019).

Willie said: "Air cargo was the standout performer in 2024 with airlines moving more air cargo than ever before. Importantly, it was a year of profitable growth. Demand, up 11.3% year-on-year, was boosted by particularly strong e-commerce and various ocean shipping restrictions. This combined with airspace restrictions which limited capacity on some key long-haul routes to Asia helped to keep yields at exceptionally high levels. While average yields continued to soften from peaks in 2021-2022 they averaged 39% higher than 2019.

“Economic fundamentals point to another good year for air cargo—with oil prices on a downward trajectory and trade continuing to grow. There is no doubt, however, that the air cargo industry will be challenged to adapt to unfolding geopolitical shifts. The first week of the Trump administration demonstrated its strong interest in using tariffs as a policy tool that could bring a double whammy for air cargo—boosting inflation and deflating trade.”

Looking to 2025, IATA estimates growth to moderate to 5.8%, aligned with historical performance.

Several factors in the operating environment should be noted:

- Global trade in goods grew by 3.6% annually in 2024.

- In December, both the manufacturing output Purchasing Managers Index or PMI (49.2) and new export orders PMI (48.2) were below the critical threshold represented by the 50 mark, indicating a decline in global manufacturing production and exports.

- US headline inflation, based on the annual Consumer Price Index (CPI), rose by 0.2 percentage points to 2.9% in December. In the same month, the inflation rate in the EU increased by 0.2 percentage points to 2.7%. China’s consumer inflation fell by 0.1 percentage points to 0.1% in December, marking the fourth consecutive year-on-year decline and reinforcing concerns about an economic slowdown.

Regional Performance

Asia-Pacific airlines saw 14.5% year-on-year demand growth for air cargo in 2024, the strongest among the regions. Capacity increased by 11.3% year-on-year. December year-on-year demand increased 8.4% and capacity increased 6.3%.

North American carriers saw 6.6% year-on-year demand growth for air cargo in 2024, the lowest of all regions. Capacity increased by 3.4% year-on-year. December year-on-year demand increased 5.3% and capacity increased 2.1%.

European carriers saw 11.2% year-on-year demand growth for air cargo in 2024. Capacity increased by 7.8% year-on-year. December year-on-year demand increased 5.1% and capacity increased 3.7%.

Middle Eastern carriers saw 13% year-on-year demand growth for air cargo in 2024. Capacity increased by 5.5% year-on-year. December year-on-year demand increased 3.3% and capacity increased 0.2%.

Latin American carriers saw 12.6% year-on-year demand growth for air cargo in 2024. Capacity increased by 7.9% year-on-year. December year-on-year demand increased 10.9%, the highest of all regions and capacity increased 8.4%.

African airlines saw 8.5% year-on-year demand growth for air cargo in 2024. Capacity increased by 13.6% year-on-year. December year-on-year demand decreased by -0.9%, the lowest of all regions and capacity increased 1.8%.

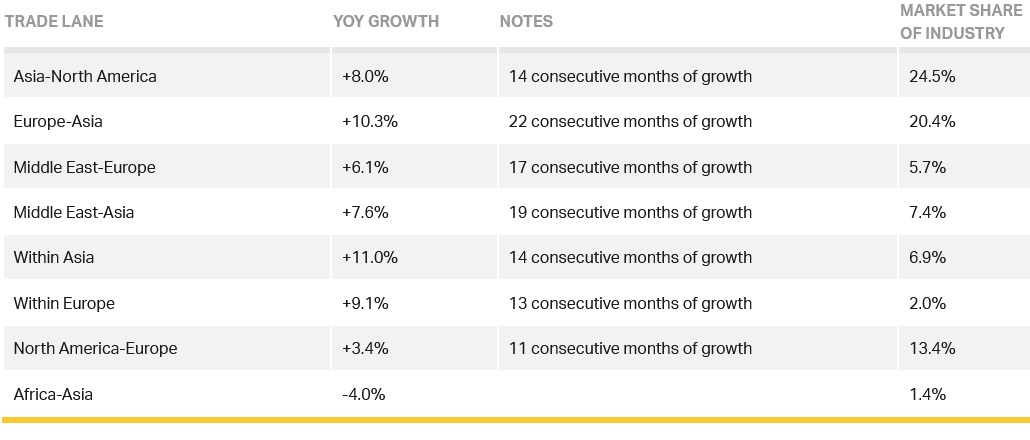

Trade Lane Growth: International routes experienced exceptional traffic levels for the 17th consecutive month with a 7% year-on-year increase in December. Airlines are benefiting from rising e-commerce demand in the US and Europe amid ongoing capacity limits in ocean shipping.